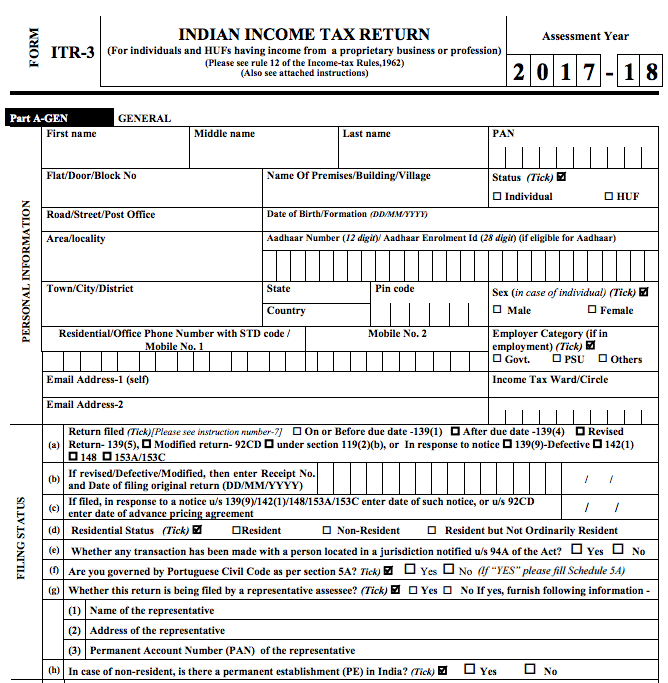

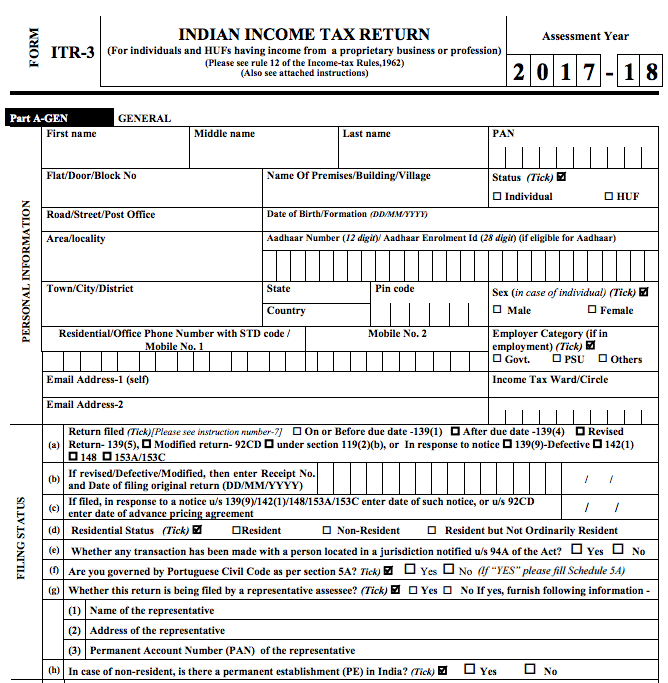

The column “Profit and Gains from Business and Profession” has been removed under Part B. Mandatory to choose the suitable option in support of residential status in IndiaĪmendments in ITR 2 Form for A.Y. Limiting the rate of surcharge on dividend income. A New Schedule has been inserted for reporting of tax deferred on ESOP. Reporting of interest accrued on Provident Fund to which no exemption is available. Dividend income taxable as per section 2(22)(e) to be reported separately. Additional disclosures are required in the Schedule of Capital Gains. Schedule FA requires reporting of foreign assets held and foreign income earned during the calendar ending 31st December. 2022-23: Here are the latest changes made in finance act 2022. The indviduals investest in unlisted equity shares of a company must file income tax return in the form ITR-2.Ĭonfused! Which ITR form to file? Check here Amendments in ITR 2 Form for A.Y. Even the director of any company can file ITR-2 for a.y. You can also file ITR-2 even your income exceeds Rs.  Income from Capital Gains (Short term or Long term) even losses. Income from House Property (Even having more than one house property). The ITR 2 form is only for Individuals and HUF. 2022-23) : If you have the following incomes then you need to file ITR 2. Who is eligibile to submit ITR-2 online (A.Y. ITR-2 Online User Manual (Official) ay 2022-23 2022-23) like excel utility, PDF format, FAQ and online user manual. You can download easily all the formats for ITR-2 (A.Y. These links are the official links provided by the official websites of the income tax department e.g.

Income from Capital Gains (Short term or Long term) even losses. Income from House Property (Even having more than one house property). The ITR 2 form is only for Individuals and HUF. 2022-23) : If you have the following incomes then you need to file ITR 2. Who is eligibile to submit ITR-2 online (A.Y. ITR-2 Online User Manual (Official) ay 2022-23 2022-23) like excel utility, PDF format, FAQ and online user manual. You can download easily all the formats for ITR-2 (A.Y. These links are the official links provided by the official websites of the income tax department e.g.

Download ITR-2 Form AY 2022-23ĭownload ITR-2 in different formats (A.Y.2022-23): Here is the table having links to download ITR-2 in different formats. In this article, we will discuss the detail of ITR-2 like online procedure, download links, excel utility, instructions, PDF format, amendments, FAQ and more. You can file ITR-2 online easily by following the below steps.

In other words, you can say that individuals and HUFs who are not having income from any business and profession can use ITR 2. ITR-2 A.Y.2022-23: ITR form 2 is for the individuals or HUFs who are not eligible to file the ITR-1 (Sahaj) form.

0 kommentar(er)

0 kommentar(er)